Insurance API Integration – The Future of Digital Insurance 2025

Introduction 🌟

The insurance trade has all the time been some of the important sectors of world economies. From defending lives and property to enabling companies and people to get better from dangers, insurance coverage is a cornerstone of economic safety. 🛡️ Nonetheless, in recent times, the trade has been present process a digital revolution—and on the coronary heart of this transformation lies API integration.

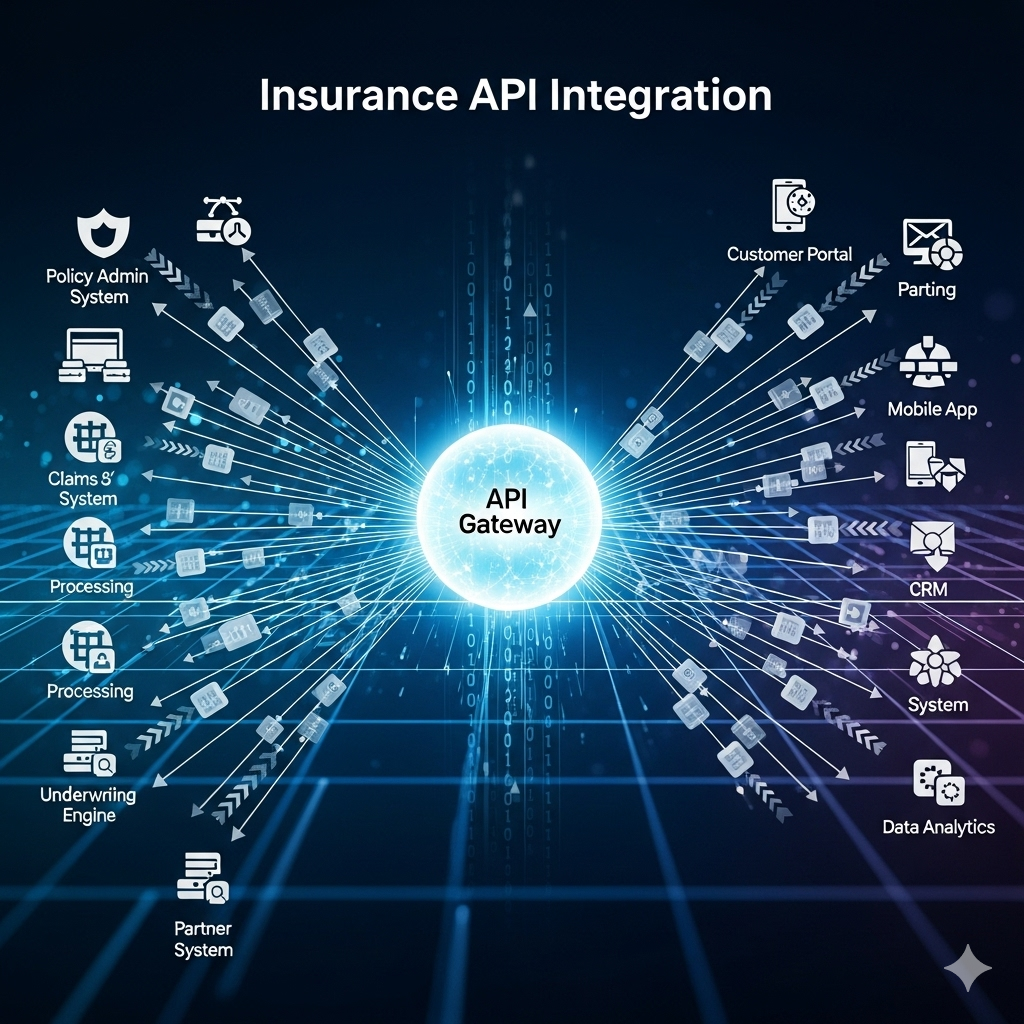

APIs (Utility Programming Interfaces) act as digital bridges that join insurance coverage firms, third-party service suppliers, clients, and platforms. By enabling seamless communication between programs, APIs assist insurers ship quicker, smarter, and extra customized experiences. 🚀📱

On this article, we’ll dive deep into Insurance API Integration, exploring its significance, advantages, challenges, use circumstances, and future potential. Prepare to find how APIs are reshaping insurance coverage within the digital-first economic system. 🌍✨

What’s Insurance API Integration? 🤔🔗

An Insurance API is a set of protocols and instruments that permit completely different functions and programs to speak with one another within the insurance coverage ecosystem.

For instance:

-

When a buyer buys automobile insurance coverage on-line 🚗💻, the web site may use an API to immediately fetch quotes from a number of insurers.

-

Equally, declare processing 📝➡️💰 may be accelerated by way of APIs that share information between insurers, hospitals, restore retailers, and fee programs.

Insurance API integration means embedding these APIs into digital platforms, making certain easy information alternate between insurers, brokers, brokers, and clients.

👉 Merely put, APIs act as digital connectors that automate and simplify insurance coverage processes.

Why is API Integration Essential in Insurance? 🌐📊

The insurance coverage trade is historically identified for complicated paperwork, guide underwriting, and lengthy declare cycles. With clients demanding velocity, transparency, and personalization, insurers want APIs to remain aggressive.

Listed here are the principle the reason why API integration is so important in insurance coverage at present:

-

Buyer Expertise Enhancement 🧑💻💡

APIs permit insurers to supply instantaneous quotes, seamless coverage issuance, and real-time declare updates. Clients need velocity and ease, and APIs make that doable. -

Ecosystem Connectivity 🔗🌍

Insurance coverage doesn’t function in isolation. It connects with banks, healthcare suppliers, automotive sellers, authorities databases, and digital platforms. APIs allow easy communication between all these gamers. -

Operational Effectivity ⚡📉

Automating information alternate reduces guide effort, cuts prices, and eliminates errors. -

Innovation and Agility 🚀💡

Insurers can shortly launch new merchandise, join with insurtech startups, and combine with rising applied sciences like AI, IoT, and blockchain. -

Knowledge–Pushed Choice Making 📊🔍

APIs present entry to huge quantities of structured information, which might enhance danger evaluation, fraud detection, and customized pricing.

Varieties of Insurance APIs 🔄📑

There are a number of varieties of APIs within the insurance coverage sector, every designed to deal with completely different points of the enterprise:

-

Quote APIs 💵📲

Fetch instantaneous insurance coverage quotes from a number of suppliers for patrons. -

Coverage Administration APIs 📄🛡️

Deal with coverage creation, updates, renewals, and cancellations. -

Claims Processing APIs 📝➡️💰

Automate declare submitting, validation, and settlement. -

Fee APIs 💳💸

Allow seamless premium funds, refunds, and declare disbursements. -

Underwriting APIs 🏦📊

Share danger information between insurers, credit score bureaus, and different sources. -

Fraud Detection APIs 🕵️♂️🚨

Analyze patterns to detect suspicious exercise and stop insurance coverage fraud. -

Third-Occasion Knowledge APIs 🌐🔍

Pull information from authorities information, car databases, or healthcare programs to validate data. -

Buyer Engagement APIs 📱💬

Assist chatbots, customer support apps, and self-service portals.

Advantages of Insurance API Integration 🌟✅

Integrating APIs into the insurance coverage ecosystem gives a variety of advantages:

1. Sooner Service Supply ⚡🚀

No extra ready for days to get quotes or file claims—APIs make it instantaneous.

2. Improved Buyer Satisfaction 🥰💬

Customized and seamless interactions enhance belief and loyalty.

3. Value Financial savings 💰📉

Automation reduces guide work, paperwork, and operational bills.

4. Market Enlargement 🌍📈

APIs permit insurers to accomplice with fintech, e-commerce, and digital platforms to succeed in new clients.

5. Enhanced Safety 🔒🛡️

Trendy APIs include encryption, authentication, and compliance options.

6. Innovation Enablement 🤖💡

APIs allow integration with AI for predictive analytics, IoT for linked units, and blockchain for safe information.

Challenges in Insurance API Integration ⚠️🛠️

Whereas APIs carry large alternatives, insurers should overcome sure challenges:

-

Legacy Methods 🖥️⏳

Many insurers nonetheless use outdated programs that don’t assist API integration. -

Knowledge Privateness Considerations 🔐📜

Dealing with delicate buyer information requires strict compliance with laws like GDPR, HIPAA, and many others. -

Safety Dangers 🚨🕵️♀️

APIs, if not secured, can turn into gateways for cyberattacks. -

Integration Complexity 🧩🔄

Connecting a number of programs with various requirements may be difficult. -

Regulatory Limitations ⚖️📑

Totally different international locations have completely different legal guidelines governing insurance coverage information. -

Excessive Preliminary Prices 💸🏗️

Creating and implementing APIs could require important funding.

Actual-World Use Circumstances of Insurance APIs 🌍💡

Let’s discover some real-world functions of insurance coverage API integration:

-

Journey Insurance coverage Integration ✈️🧳

Journey reserving web sites use APIs to immediately provide journey insurance coverage alongside flight tickets. -

Automotive Insurance coverage in Dealerships 🚗🛒

Automotive sellers use APIs to supply insurance coverage quotes on the time of auto buy. -

Healthcare Insurance coverage Claims 🏥💉

Hospitals use APIs to confirm insurance coverage protection and course of claims immediately. -

E-commerce Insurance coverage 🛍️📦

On-line platforms provide product safety and return insurance coverage by way of APIs. -

Embedded Insurance coverage 📲🤝

APIs permit insurance coverage to be bundled with fintech apps, ride-sharing platforms, and even smartphones.

The Position of APIs in Embedded Insurance 📱🛡️

Embedded insurance coverage means integrating insurance coverage straight into the platforms the place clients make purchases. APIs make this doable.

Examples:

-

Shopping for a cellphone 📱? Immediately add gadget insurance coverage by way of API.

-

Reserving a flight ✈️? Get journey insurance coverage in a single click on.

-

Utilizing a fintech app 💳? Add life or medical insurance seamlessly.

This frictionless expertise is powered totally by APIs.

How APIs Energy Digital Transformation in Insurance coverage 🚀💻

APIs are usually not simply instruments—they’re drivers of digital transformation.

-

AI + APIs 🤖🔗 = Customized danger evaluation.

-

IoT + APIs 📡🔗 = Utilization-based insurance coverage (e.g., pay-as-you-drive).

-

Blockchain + APIs ⛓️🔗 = Safe, clear declare settlements.

-

Large Knowledge + APIs 📊🔗 = Actual-time fraud detection and predictive analytics.

Collectively, these integrations are reshaping how insurers innovate and serve clients.

Way forward for Insurance API Integration 🔮🌐

The long run seems vibrant for insurance coverage APIs. Key traits embody:

-

Open Insurance coverage Ecosystem 🌍🔗

Identical to open banking, open insurance coverage will permit clients to share information securely throughout platforms. -

Hyper-Personalization 🧑🤝🧑💡

APIs will allow tailor-made insurance coverage merchandise primarily based on particular person habits and preferences. -

AI-Powered APIs 🤖📊

Smarter APIs will analyze dangers, detect fraud, and ship predictive insights. -

International Standardization 🌎📜

Extra commonplace API protocols will emerge, making integration simpler worldwide. -

Rise of Insurtech Partnerships 🤝💼

Startups and conventional insurers will collaborate extra by way of APIs.

Finest Practices for Profitable Insurance API Integration 🛠️✅

To maximise the advantages of API integration, insurers ought to observe these finest practices:

-

Use Safe Authentication 🔒🔑 (OAuth 2.0, JWT).

-

Guarantee Regulatory Compliance ⚖️📜.

-

Undertake API Administration Instruments 🧰📊 (like Apigee, MuleSoft).

-

Use Commonplace Protocols 🔗 (REST, GraphQL).

-

Allow Scalability 🚀📈.

-

Give attention to Buyer-Centric Design 🧑💻💬.

Conclusion 🎯🌟

Insurance API integration is not simply an choice—it’s a necessity in at present’s digital-first world. 🌐💼 From enhancing buyer expertise to enabling embedded insurance coverage and powering AI-driven improvements, APIs are remodeling the complete trade.

Sure, challenges like safety, compliance, and legacy programs exist, however with correct technique and execution, insurers can unlock large alternatives. 🚀✨

Because the trade strikes towards open insurance ecosystems, the longer term will probably be about collaboration, connectivity, and customer-centric innovation. 💡🌍

👉 The underside line: Insurance APIs are usually not simply technical instruments—they’re the important thing to a wiser, quicker, and extra inclusive insurance coverage future. 🛡️💻