💡 Top 10 Things Every Discover the Top 10 Things Every

Sole Trader Should Know in the UK (2025) — from registration and taxes to branding, expenses, and legal tips. 💼

One of the most thrilling and liberating choices you can make is to launch your own company as a sole proprietor. Being a sole trader allows you to work on your own terms and create something wholly unique, regardless of your background as a freelancer, consultant, online seller, tradesperson, or creative professional.

There is more to the idea than meets the eye, even though it seems straightforward: “I’ll just work for myself.” Knowing how to properly manage your business will ultimately save you time, money, and stress—from taxes to branding to legal obligations.

Let’s get started! 🚀

The Top 10 Things Every Sole Trader Should Know Before (and After) Beginning Their Journey in the UK are listed here.

🏁 1. What It Really Means to Be a Sole Trader

One of the main reasons for the popularity of sole traders in the UK is that they are the most straightforward type of business structure. You are self-employed as a sole trader, which means you are fully in charge of and own your company. You are personally liable for your company’s debts and liabilities, make all of the decisions, and keep all of the profits.

“You” and “your business” are one and the same legally. This implies that you are fully liable for any debts or losses, but you also keep all of your earnings after taxes.

A company does not have to be registered with Companies House. Rather, you merely register for Self Assessment with HM Revenue & Customs (HMRC) in order to pay income tax on your earnings.

💬 Consider this: if you work for yourself as a freelance plumber, hairdresser, or designer, you are probably a sole trader!

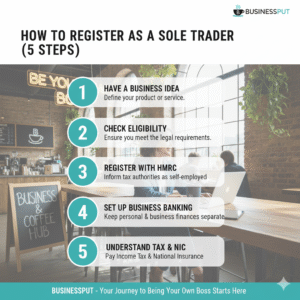

📝 2. How to Register as a Sole Trader (Step-by-Step)

In the UK, becoming a sole proprietor is surprisingly easy. Here’s how to do it:

- Decide on a name for your company.

You can establish a business name or trade under your own name. Just be sure it’s not deceptive (for example, “Ltd” if you’re not a limited company).

2. Sign up with HMRC.

Register for Self Assessment on the HMRC website. To file your taxes, you will be given a Unique Taxpayer Reference (UTR).

3. Maintain financial documentation

Keep track of all earnings, outlays, invoices, and receipts. HMRC might request to see them, particularly in the event of an audit.

4. Every year, submit your tax return.

Every year, by January 31st, submit your self-assessment tax return (for the prior tax year).

5. Pay your taxes and national insurance.

You will be required to pay both income tax and Class 2 and Class 4 National Insurance contributions once your income reaches specific thresholds.

That’s it! Officially, you own your own business 🎉

💷 3. Understand How Taxes Work

This is a significant issue that all sole proprietors should be aware of from the outset.

No one automatically deducts taxes when you work for yourself. It is your responsibility to report your income and make the appropriate tax payments.

Here’s a quick summary:

Income Tax: Your profits, not your total income, are subject to tax. Income less permitted business expenses equals profits.

-

Tax Bands (2025):

-

Up to £12,570 → 0% (Personal Allowance)

-

£12,571 to £50,270 → 20% (Basic Rate)

-

£50,271 to £125,140 → 40% (Higher Rate)

-

Over £125,140 → 45% (Additional Rate)

-

-

National Insurance:

-

Class 2 NICs if your profits are above £6,725 per year.

-

Class 4 NICs if profits exceed £12,570.

-

💡 Tip: Use accounting software like QuickBooks, Xero, or FreeAgent to track your earnings and expenses. It’ll make tax season much easier.

💼 4. Know Your Legal Responsibilities

Even though starting a business as a sole proprietor is easy, there are still legal obligations to fulfill.

You have to:

Maintain thorough records of your earnings and outlays.

If your turnover surpasses £90,000 (2025 threshold), you must register for VAT.

Verify that your company name isn’t already a trademark or offensive.

Observe all industry rules, such as those pertaining to data protection, food hygiene, and health and safety.

All business debts and legal claims are your personal responsibility.

This implies that creditors may seize your personal assets, including your home or vehicle, if your company is unable to pay its debts.

💬 Pro tip: Think about obtaining insurance (income protection, professional indemnity, or public liability). It’s a small cost for big peace of mind.

🧾 5. Keep Your Business and Personal Finances Separate

Combining personal and business funds is one of the most frequent errors made by new sole proprietors.

Although having a separate bank account is not legally required, it is strongly advised.

Why?

It facilitates keeping track of earnings and outlays.

makes filing taxes easier.

gives clients a more polished appearance.

🎯 Advice: Create a distinct business bank account. Numerous UK banks, such as Starling, Monzo, or Tide, provide free accounts for sole proprietors.

🧮 6. Know What Expenses You Can Claim

As long as the expenses are legitimate and essential for your business, you can claim them to drastically lower your tax liability.

The following are typical expenses that sole proprietors are permitted to incur:

Office expenses include phone bills, software, and stationery. Mileage, gas, parking, and train tickets are all part of the trip expenses. Home Office: a percentage of rent, utilities, and internet 📦 Materials or stock: things you sell or utilize for your job 🎓 Training: pertinent classes or credentials 💼 Marketing: advertisements, websites, and social media campaigns 👩💻 Professional fees, such as those for membership, accounting, or law

For instance, you can deduct some of your internet and electricity costs as business expenses if you work from home two days a week.

Keep digital receipts and track everything — it’s gold when filing taxes.

📊 7. Plan for Your Business Growth

While it’s simple to concentrate on daily tasks, astute sole proprietors also make plans for expansion.

Consider this:

How can I expand my customer base or reach?

Should I increase my prices or rates?

Could I use subcontractors or independent contractors?

For tax reasons, is it time to switch from being a sole proprietor to a limited company?

💡 Advice: It might be worthwhile to think about forming a Limited Company (Ltd) if your profits increase significantly (typically over £40,000 to £50,000 per year) as it can provide greater tax efficiency and safeguard your personal assets.

As your company expands, you can always start small.

🤝 8. Build Your Brand and Network

Your brand is important, even if your company is run by just one person!

People buy from people, and you can differentiate yourself with your presentation, values, and personality.

Here’s how a sole proprietor can develop a powerful brand:

Make a straightforward logo and company name.

Create a polished website, even if it is only one page long.

Keep your branding consistent on all social media platforms.

Request reviews and testimonials from pleased customers.

Join local business associations or online communities.

💬 For instance, a freelance photographer who posts behind-the-scenes photos on Instagram may draw in more business than one who only shares portfolio images.

Keep in mind that your name is your company, so make it memorable!

🧠 9. Prepare for Slow Months and Save for the Future

Because you are your own boss, your monthly income may fluctuate. Some months you’ll be thriving; others may be quiet.

For this reason, every astute sole proprietor ought to: 💰 Put aside money for emergencies, ideally enough to cover three to six months’ worth of costs. 📆 Set aside at least 20–25% of every payment for tax purposes. 🏦 Think long-term and start a pension plan (yes, you can do that as a self-employed person!).

Pension choices:

Self-Invested Personal Pension (SIPP) or Personal Pension

It’s a win-win situation because you receive tax relief on contributions!

💬 Keep in mind that you are your own safety net, so make plans appropriately.

📣 10. Stay Compliant, Stay Informed, Stay Inspired

Tax laws and the business world are subject to frequent changes. You should stay current and continue to learn as a sole proprietor.

Maintain compliance by:

Receiving email updates from HMRC

Making use of accounting software that adjusts to new regulations

If necessary, collaborating with a certified accountant

📈 Be aware of:

Tax updates and VAT thresholds

Rules governing the industry

Marketing trends that support the expansion of your company

And above all, continue to be inspired.

Owning your own company can be challenging. There will be long days, moments of uncertainty, and periods of low motivation. However, every little victory, such as your first customer, sale, or favorable review, is cause for celebration.

You’re living life on your terms, developing a brand, and creating opportunities in addition to making money. 🌟

🧾 Bonus Tip: When to Switch from Sole Trader to Limited Company

Many business owners begin as sole proprietors and, as their businesses expand, register as limited companies.

You may want to switch if:

You make between £50,000 and £60,000 annually.

Personal and business liability should be kept apart.

You intend to enlist partners or investors.

You want to come across as more reliable to suppliers or customers.

💬 Keep in mind: Being a sole proprietor offers flexibility, so there’s no rush. When it’s appropriate for you, you can scale.

🌟 Be Proud to Be a Sole Trader

In the UK, being a sole trader entails freedom, independence, and creativity, but it also necessitates self-motivation, organization, and discipline.

You should be proud of the fact that you are the CEO, accountant, marketer, and customer service agent all combined into one!

Therefore, whether you are just beginning your freelance career or have been working for yourself for years, never forget why you started and keep learning and growing.

🚀 Because working for yourself allows you to build your dream rather than just a business.