🛡️ Life Insurance: Protecting Your Future, One Policy at a Time

Life is unpredictable — moments of joy, moments of challenge. 💖 One way to ensure that your loved ones are financially secure no matter what happens is through life insurance.

Whether you’re starting your career, raising a family, or planning for retirement, life insurance is a key component of financial planning.

In this guide, we’ll cover everything about life insurance, including:

-

✅ Types of policies

-

✅ How it works

-

✅ Benefits and myths

-

✅ Step-by-step guide to choosing a policy

-

✅ Real-life examples

-

✅ Future trends

-

✅ Expert tips for maximizing value

Let’s dive in! 🌊

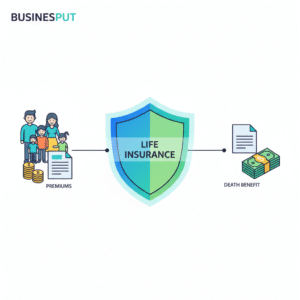

🌟 What is Life Insurance?

At its core, life insurance is a contract between you and an insurance company. You pay regular premiums, and the insurer provides a lump-sum payment (death benefit) to your beneficiaries if something happens to you.

Think of it as a financial safety net for the people you care about most. 👨👩👧👦

Key Components:

-

💰 Premiums – The amount you pay, monthly or yearly, to keep the policy active.

-

🛡️ Coverage / Death Benefit – The payout your loved ones receive if you pass away.

-

👨👩👧👦 Beneficiaries – People who receive the death benefit (family, spouse, or children).

Life insurance isn’t just about death benefits — it can protect your family, secure your debts, and even act as a financial tool while you’re alive.

🧩 Types of Life Insurance

Not all life insurance policies are the same. Choosing the right one depends on your goals, age, financial situation, and family needs. Let’s explore the main types:

1️⃣ Term Life Insurance

-

Coverage period: 10, 20, or 30 years

-

Premiums: Affordable compared to permanent policies

-

Benefits: Provides financial protection for a specific period

-

⚡ Best for: Young families, mortgage coverage, or temporary financial obligations

💡 Example: A 30-year-old parent buys a 20-year term life policy to cover the mortgage and children’s education. If something happens within 20 years, the family receives the payout to pay off debts and secure their future.

Why it’s popular:

-

Quick and simple to understand.

-

Premiums are generally lower than permanent policies, making it ideal for first-time insurance buyers.

-

Flexible options allow you to match coverage to specific needs, like a mortgage or school fees.

Consideration: Term life insurance doesn’t build cash value. If the policy expires and you’re still alive, the coverage ends. However, many insurers now offer convertible term policies, which can switch to permanent coverage later.

2️⃣ Whole Life Insurance

-

Coverage period: Lifetime

-

Premiums: Higher than term, but stay fixed over time

-

Benefits: Includes a cash value component that grows over time

-

⚡ Best for: Long-term wealth building, estate planning, leaving a legacy

💡 Example: A business owner purchases a whole life policy. Over 20 years, the policy accumulates cash value that can be borrowed for emergencies, business expansion, or retirement.

Why it’s valuable:

-

Builds long-term savings while providing protection.

-

Fixed premiums make it easier to budget over time.

-

Cash value grows tax-deferred, which can act as a source of funds for emergencies or opportunities.

Consideration: Premiums are significantly higher than term insurance, so it’s more suitable for those who can commit to long-term payments.

3️⃣ Universal Life Insurance

-

Coverage period: Flexible, potentially lifelong

-

Premiums: Adjustable, based on financial needs

-

Benefits: Combines death benefit with savings and investment growth

-

⚡ Best for: People seeking flexibility, with changing financial obligations over time

💡 Example: A young professional chooses a universal life policy that allows increasing coverage as their family grows, while part of the premium accumulates as a savings component.

Why it’s attractive:

-

Provides flexibility to increase or decrease coverage over time.

-

Part of the premium goes toward a cash value account, which can be invested or used to pay future premiums.

-

Often includes options for riders, like critical illness or disability coverage.

Consideration: Because premiums and investments fluctuate, universal life insurance requires active management. It’s best suited for those comfortable with monitoring their policy regularly.

4️⃣ Indexed and Variable Life Insurance

For those looking to combine protection with investment potential:

-

Indexed Life Insurance: Cash value grows based on a stock market index (e.g., S&P 500), offering growth potential with some protection from market losses. 📈

-

Variable Life Insurance: Policyholders can allocate cash value to different investment options like stocks and bonds, giving the highest growth potential but more risk. 💹

💡 Example: A 40-year-old investor uses variable life insurance to grow cash value alongside market investments while keeping a death benefit for family protection.

⚖️ Comparing Policy Types

| Feature | Term Life | Whole Life | Universal Life | Variable / Indexed Life |

|---|---|---|---|---|

| Coverage Duration | Specific term | Lifetime | Lifetime (flexible) | Lifetime |

| Premiums | Low | Higher, fixed | Adjustable | Adjustable, higher risk |

| Cash Value | ❌ | ✅ | ✅ | ✅ (market-linked) |

| Flexibility | Limited | Low | High | High |

| Investment Component | ❌ | Low | Moderate | High |

🌟 Benefits of Life Insurance

Life insurance offers more than just a death benefit. Here’s why it’s essential:

-

🏡 Protects Your Family’s Lifestyle – Ensures your loved ones can cover housing, education, and daily expenses.

-

💳 Covers Debts – Mortgage, loans, and credit cards don’t become a burden.

-

📈 Financial Planning – Policies with cash value act as savings or retirement supplements.

-

💖 Peace of Mind – Knowing your family is protected brings emotional relief.

💡 Real-Life Scenario:

A 35-year-old with two children and a mortgage unexpectedly passes away. With life insurance, the family can:

-

Pay off the mortgage 🏠

-

Cover children’s education 🎓

-

Maintain their lifestyle 💼

👥 Who Should Consider Life Insurance?

-

👶 Parents – Ensure children’s education and family security.

-

🧑💼 Young Professionals – Affordable premiums while healthy.

-

💼 Business Owners – Protect key personnel and business continuity.

-

👵 Retirees – Cover estate taxes or leave a legacy.

Even if you’re healthy and young, early adoption locks in lower premiums and guarantees long-term protection. ⏱️

🏆 Step-by-Step Guide to Choosing the Right Life Insurance

Buying life insurance doesn’t have to feel overwhelming. Breaking it down step by step makes it easier to understand, plan, and choose the best policy for you and your loved ones.

1️⃣ Determine Your Coverage Needs 💭

Start by asking yourself:

-

How much debt do I have? 🏠💳

-

What will my family need for living expenses? 🍎📚

-

Do I want to leave a financial legacy? 🌱

A common rule of thumb: Coverage = 10–15 times your annual income. But remember, everyone’s situation is unique.

2️⃣ Choose the Right Type of Policy 🧩

-

Term Life – Affordable, simple, ideal for temporary needs.

-

Whole Life – Lifelong protection with cash value growth.

-

Universal Life – Flexible coverage with investment potential.

-

Indexed/Variable Life – Investment-linked policies with higher growth potential.

3️⃣ Compare Insurance Providers 💻

Not all insurers are equal. Look for:

-

✅ Reputation & reliability

-

✅ Claim settlement ratio

-

✅ Customer service quality

-

✅ Flexibility and riders offered

💡 Tip: Don’t just pick the cheapest policy — reliability matters more than price.

4️⃣ Consider Optional Riders 🧩

Riders are add-ons that enhance your policy. Popular options include:

-

Critical illness coverage 🏥

-

Accidental death benefit ⚡

-

Waiver of premium (if you become disabled) 🛡️

These riders can increase protection and peace of mind, especially if you have dependents or specific risks.

5️⃣ Review and Update Regularly 🔄

Life changes — marriage, kids, new home, career growth. Make sure your life insurance grows with you. Set a schedule to review your policy every 2–3 years and adjust coverage as needed.

❌ Common Myths About Life Insurance

Many people hesitate to buy life insurance because of myths. Let’s debunk the most common ones:

-

🧑🎓 “I’m too young to need life insurance.”

-

Truth: Buying early locks in lower premiums and ensures coverage while you’re healthy.

-

-

💸 “Life insurance is too expensive.”

-

Truth: Term life is often affordable, sometimes less than a daily coffee ☕.

-

-

👨👩👧 “My spouse or partner doesn’t need it.”

-

Truth: Life insurance protects your family from unexpected expenses, like debts or childcare costs.

-

-

📊 “Life insurance only pays out when you die.”

-

Truth: Permanent policies can accumulate cash value, act as investments, and support retirement planning.

-

-

🤔 “I don’t need insurance if I’m single.”

-

Truth: Even singles have debts, student loans, and end-of-life expenses that someone may need to cover.

-

📊 Real-Life Case Studies

1️⃣ Family Protection 👨👩👧👦

A 35-year-old father of two purchased a 20-year term policy. After an unexpected accident, the policy payout ensured the children’s education and mortgage were covered. The family didn’t have to worry about financial stress during a tough time.

2️⃣ Business Continuity 💼

A small business owner took out key person insurance for their co-founder. When the co-founder passed away unexpectedly, the payout helped the business continue operations, retain employees, and recover revenue losses.

3️⃣ Investment & Retirement 🌱💰

A young professional bought a whole life policy at age 30. Over 25 years, the cash value grew steadily. At retirement, they could use part of the cash value as supplementary income, while still leaving a death benefit for heirs.

🌐 Future Trends in Life Insurance

Life insurance is evolving, and modern technology is making it smarter, faster, and more personalized.

-

🤖 AI & Big Data – Insurers can now provide personalized policies, assess risks faster, and automate underwriting.

-

📱 Digital Platforms – Applications, claims, and renewals can all be done online in minutes.

-

⌚ Wearables & Health Integration – Linking fitness trackers can lower premiums for healthier lifestyles.

-

🔗 Blockchain & Smart Contracts – Transparent policies, instant claims processing, and secure data storage.

💡 Example: Some insurers now allow policyholders to connect wearable devices. Exercising regularly can reduce premiums, incentivizing healthy living while protecting your family.

🔍 Expert Tips for Maximizing Your Life Insurance

-

Start early ⏱️ – Younger applicants pay lower premiums and enjoy longer coverage.

-

Calculate coverage realistically 🎯 – Consider debts, lifestyle, and future needs, not just income.

-

Review policies regularly 🔄 – Adjust coverage as life changes.

-

Combine policies with other financial planning tools 💼 – Emergency funds, retirement accounts, and investments can complement insurance.

-

Ask about riders 🧩 – These add-on protections can make your policy more comprehensive.

-

Understand policy terms fully 📖 – Know the premiums, coverage, exclusions, and cash value benefits.

✅ Key Takeaways

-

Life insurance provides financial protection and peace of mind 💖

-

Early adoption saves money and ensures long-term security ⏱️

-

Policies can be protection-only (term) or investment-oriented (whole/universal) 🌱

-

Life insurance is becoming digital, flexible, and innovative 📱🤖

-

Educate yourself, compare policies, and choose coverage that fits your family and goals 🛡️

Life insurance isn’t just about money — it’s about protecting your loved ones, planning for the future, and creating a financial safety net. With the right strategy, it’s a powerful tool for peace of mind, security, and long-term financial well-being. 🌟