🔐 Setting Up a Secure Crypto Wallet for Investment in 2026, Learn how to set up a secure crypto wallet in 2026! Step-by-step guide for beginners and investors

By 2026, cryptocurrencies will no longer be confined to the realm of specialized discussions within the tech community. It has evolved into a crucial aspect of international finance, individual investment plans, and long-term wealth management.

Individuals allocate funds to cryptocurrencies to enhance portfolio stability, safeguard against economic volatility, assert digital asset control, and engage in the evolution of financial systems. Despite the significant progress, a single critical oversight continues to result in massive financial losses for investors annually: inadequate wallet protection.

The truth is simple but often ignored: Crypto itself is secure. People are not.

Crypto losses are typically caused by mistakes in wallet setup, mishandling of recovery phrases, or trusting scams too readily, rather than blockchain failures. This manual aims to alter that. Should you invest in cryptocurrencies in 2026, whether with $100 or $100,000, this article will guide you on how to establish a safe crypto wallet correctly, with thoroughness, patience, and assurance. No hype. No fear-mongering. Just real guidance that protects real money.

🌍 Why Crypto Wallet Security Matters More Than Ever in 2026

The adoption of cryptocurrencies has progressed to a point where individual accountability is taking precedence. Governments, trading platforms, and organizations now promote self-custody, implying that individuals manage their assets directly, without relying on banks or third parties. This shift brings freedom, but also risk. In 2026:

• Scams are more sophisticated

• Fake wallet apps look professional

• Phishing messages feel personal

• Fraudsters impersonate real companies convincingly Concurrently, crypto transactions are inherently unalterable. There is no chargeback, no reversal, and no recourse to recover lost funds from customer service.

This makes wallet security essential for three reasons:

- Ownership is absolute – whoever controls the private key controls the funds

- Mistakes are permanent – one wrong click can cost everything

- Recovery depends entirely on you – not a company or authority

Crypto rewards responsibility. It punishes carelessness.

👤 Crypto Wallet Account

A crypto wallet holds digital assets, unlike a traditional bank account which stores physical currency. It lacks the conventional use of currency. In contrast, it grants you access to your wallet’s private keys, enabling you to send, receive, and manage digital assets on the blockchain. By establishing a wallet account, you are essentially creating a digital identity on the blockchain.

This identity is secured via cryptographic keys, not relying on personal information such as your name or ID. In self-custody wallets, you alone have control over the account. There is no overarching body that can reset your password or retrieve funds if your access is compromised. This enhances the capabilities of crypto wallet accounts, yet they require significant effort. The responsibility is entirely on the user, hence the significance of security awareness.

🧠 What a Crypto Wallet Really Is

A widespread misconception is that, similar to a bank account, a cryptocurrency wallet “stores” coins. It doesn’t.

Private keys, which are cryptographic credentials that demonstrate your ownership of digital assets listed on the blockchain, are kept in a cryptocurrency wallet.

Here’s a straightforward comparison:

• Your cryptocurrency is stored on the blockchain, which is a publicly accessible record; it is not on your phone or laptop; the key to access and transfer it is stored in your wallet.

If you:

• Share the key and someone else takes over;

• Lose the key and you are no longer able to access

Because of this, cryptocurrency wallets are gatekeepers of ownership rather than merely tools.

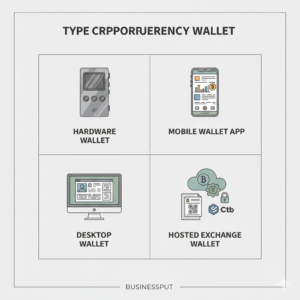

🧾 Types of Crypto Wallets in 2026

Not every wallet was made with the same intention. Knowing the different sorts of wallets enables you to select the ideal degree of convenience and security.

🔥 Hot Wallets: Practicality Initially

Hot wallets have an internet connection. These consist of desktop programs, browser extensions, and mobile applications.

They are used because they are simple to set up and provide quick access to funds.

• Beneficial for learning and small transactions • Perfect for novices

Risks to be aware of include: • Increased vulnerability to malware and phishing; • Dependency on device security; and • Unsuitable for significant investments

👉 2026’s best use:

Small quantities, daily use, and learning—not long-term storage.

❄️ Cold Wallets: Security First

Private keys are kept entirely offline in cold wallets. The majority are hardware items made especially for storing cryptocurrency.

Why they are preferred by investors:

• Keys are never connected to the internet.

Highly resilient to hacking; intended for long-term storage

Trade-offs

Frequent trading is less convenient; careful handling and backups are necessary.

👉 2026’s best use:

peace of mind, serious portfolios, and long-term investments.

Cold wallets are seen by many investors as the distinction between temporarily holding cryptocurrency and actually owning it.

🏦 Exchange Wallets: Temporary and Risky

Custodial wallets run by trading platforms are called exchange wallets. Although they are practical, they have drawbacks.

The main issue is that you have no control over the private keys.

Hacks, freezes, regulatory limitations, and problems with account access are some of the challenges that exchanges may encounter. The best use is for short-term trading only, never for long-term storage.

“Not your keys, not your crypto” is an adage that still applies in 2026.

🏦 Hosted Crypto Wallet

A hosted cryptocurrency wallet is one that is run by a third party, typically a financial platform or cryptocurrency exchange. With this kind of wallet, the business handles security, access, and recovery while holding your private keys on your behalf.

Because hosted wallets function similarly to conventional online banking, many novices find them to be comfortable. The platform handles the technical aspects after you log in with your email address and password.

Hosted wallets do have a significant drawback, though. Despite their ease of use, you do not have complete control over your cryptocurrency. Your access may be restricted if the platform encounters technical difficulties, legal limitations, or account freezes.

2026’s best use:

Hosted wallets are appropriate for traders or novices who are still learning. They are not ideal for long-term investors who want full ownership and independence.

🎯 Choosing the Right Wallet for Your Investment Strategy

An astute investor selects wallets according to strategy rather than popularity.

• How long do I intend to hold?

• What is my investment amount?

• How frequently will I transfer money?

• To what extent does maximum security matter to me?

A Well-Rounded 2026 Wallet Plan

Many seasoned investors make use of several wallets:

• Small, active funds in a hot wallet

• Long-term holdings in a cold wallet

• Exchange wallet → temporary trade

🛠️ Step-by-Step: Setting Up a Secure Crypto Wallet properly

This is where the majority of novices make mistakes—not because it’s hard, but because they rush.

Step 1: Only Use Official Sources for Downloads

Wallets should always be downloaded from:

• Verified app stores;

• Official websites

Never put your trust in

• Links to social media

• Messages posing as support; • Emails claiming “urgent action”

Fake wallet apps are among the most popular scam techniques in 2026.

Step 2: Make Your Wallet in a Secure Setting

When configuring your wallet:

• Make use of a secure, private internet connection

Steer clear of public Wi-Fi and maintain uninterrupted focus.

This should not be done carelessly.

Step 3: Protect the Recovery Phase (The Most Important Phase)

The best backup is your recovery phrase, often known as your seed phrase. Your wallet may be restored on any device, anywhere.

The best methods:

Write it down by hand; store it offline; maintain many backups; and store backups in different safe places.

Never save anything digitally, take screenshots, email it, or share it with anyone.

Your phone number and password are not necessary if someone manages to obtain this phrase. Your cryptocurrency is already theirs.

Step 4: Make Wallet Security Settings Stronger

After the creation of your wallet:

• Create a secure PIN or password.

Turn on notifications if they are available; use auto-lock features; and enable biometric security.

In the event that your gadget is misplaced or stolen, these safeguard your wallet.

Step 5: Before sending big sums of money, always test

Prior to sending large sums of money:

Send a brief test transaction; carefully verify the address; then wait for confirmation.

Numerous investors have avoided irreversible errors because to this straightforward routine.

₿ How to Create a Bitcoin Account

Opening a bank account is not the same as creating a Bitcoin account. In the world of cryptocurrency, setting up a Bitcoin wallet creates a Bitcoin account.

To put it simply, here is how it operates:

You start by selecting a reliable Bitcoin wallet (hardware, desktop, or mobile). The wallet automatically creates a recovery phrase and a Bitcoin address when you install or activate it. You use this address to get Bitcoin.

There is no need for papers. Approval is not required. Once the wallet is created, the account appears on the blockchain immediately.

Once everything is set up, you may either receive Bitcoin directly from someone else or purchase it from an exchange and move it to your wallet.

The most important thing to keep in mind is that your private keys are what govern your Bitcoin account. You still own your Bitcoin if you protect them.

🚫 Common Wallet Mistakes Investors Still Make in 2026

Even seasoned investors occasionally commit preventable mistakes:

Reusing passwords and believing fraudulent customer service

Ignoring wallet updates; digitally storing recovery phrases; hurrying transactions; and using unfamiliar programs or extensions

Errors are not forgiven in cryptocurrency; instead, lessons are eternally imparted.

🔒 Advanced Security Habits for Serious Investors

These behaviors are important if cryptocurrency is a component of your long-term financial strategy:

• Make use of a specific email address for cryptocurrency

• Make two-factor authentication available everywhere.

Use a VPN on untrusted networks; update operating systems and apps; stay away from strange DeFi protocols; and double-check addresses.

Security is a regular practice rather than a one-time setting.

🌐 What Happens If You Lose Your Phone or Wallet?

Your cryptocurrency is stored on the blockchain rather than the device.

You can get your wallet back if you still have your recovery phrase.

• Your money is secure.

If both are lost:

• Money is never accessible.

For this reason, backups are more important than gadgets.

📈 How Wallet Security Improves Investment Decisions

You experience less worry and steer clear of panic selling when your assets are protected.

• You consider the long term.

• You make wiser choices.

One of the main causes of investor failure is emotional trading, which is lessened by security.

🔐 Bitcoin Wallet

The device that lets you safely store, send, and receive Bitcoin is called a wallet. It contains the private keys that demonstrate your Bitcoin ownership on the blockchain.

Bitcoin wallets are available in a variety of formats, including desktop software, hardware, mobile apps, and even paper backups. The ratio of convenience to security varies depending on the type.

Using a safe Bitcoin wallet, particularly a cold wallet, is regarded as best practice for long-term investors in 2026. It gives you complete management while shielding your Bitcoin from online risks.

A personal Bitcoin wallet grants you actual ownership, in contrast to exchange accounts. Without your consent, no third party may restrict, freeze, or access your money.In simple words:

👉 If you control the Bitcoin wallet, you control the Bitcoin

Chasing rapid riches is no longer the goal of cryptocurrency investing in 2026. It has to do with accountability, discipline, and ownership.

A safe cryptocurrency wallet:

• Preserves your money

• Preserves your perspective

• Safeguards your future

The most successful investors are the most cautious, not the fastest or loudest.

Keep your keys safe. Keep your habits safe. Safeguard your investment. 🔐